Table of Contents

Buy now, pay later is the new way to pay in the rapidly evolving middle east financial landscape. It’s helping businesses and customers in the gulf region buy things they otherwise couldn’t afford. Tabby, a UAE FinTech startup, uses tech innovation and a digital payment approach to reshape the way people shop, enhancing the business for UAE sellers and guaranteeing customer satisfaction. It is also paving the way forward for the startup ecosystem in the Middle East region.

Tabby Founder

Hosam Arab is a well-known entrepreneur and investor in the Middle East and North Africa region. He is the co-founder and CEO of Tabby, a digital shopping assistant that helps consumers compare prices and find the best deals across various e-commerce platforms. Arab has a strong background in entrepreneurship, having co-founded and served as CEO of Namshi, a fashion e-commerce platform that was acquired by Emaar Malls in 2019.

According to Crunchbase, Arab has made three investments through Tabby, including a seed round investment in Pluto Card, a fintech startup that raised $6 million in February 2022. He has also invested in Opontia, a digital commerce platform that raised $20 million in debt financing in June 2021.

Arab has a strong network of investors and partners, having worked with prominent venture capital firms such as Global Founders Capital and Adapt Ventures. He has also participated in various events and conferences, including Fintech Surge 2022 and Webit Digital Commerce Summit.

In addition to his work in entrepreneurship and investing, Arab has been featured in several news articles and publications, including TechCrunch, Entrepreneur, and Arab Business. He has also been recognized for his contributions to the startup ecosystem in the Middle East and North Africa region.

Let’s embrace the future of payment by unwinding how Tabby affects Middle Eastern businesses:

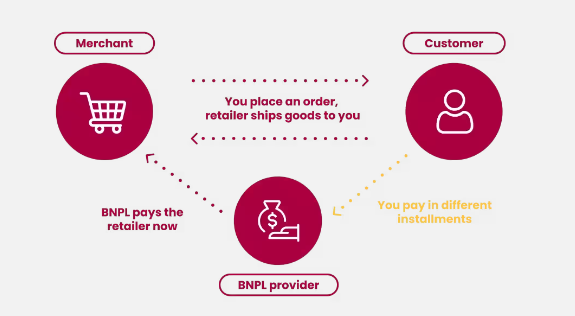

What is the Buy-now-pay-later payment system

Buy now, pay later is a disruptive payment method that offers payment solutions and allows customers to make big purchases and split the payment in installments over time. The customer doesn’t have to immediately pay in full, increasing customer satisfaction and reducing cart abandonment rates as the customer doesn’t have to pay the full amount upfront.

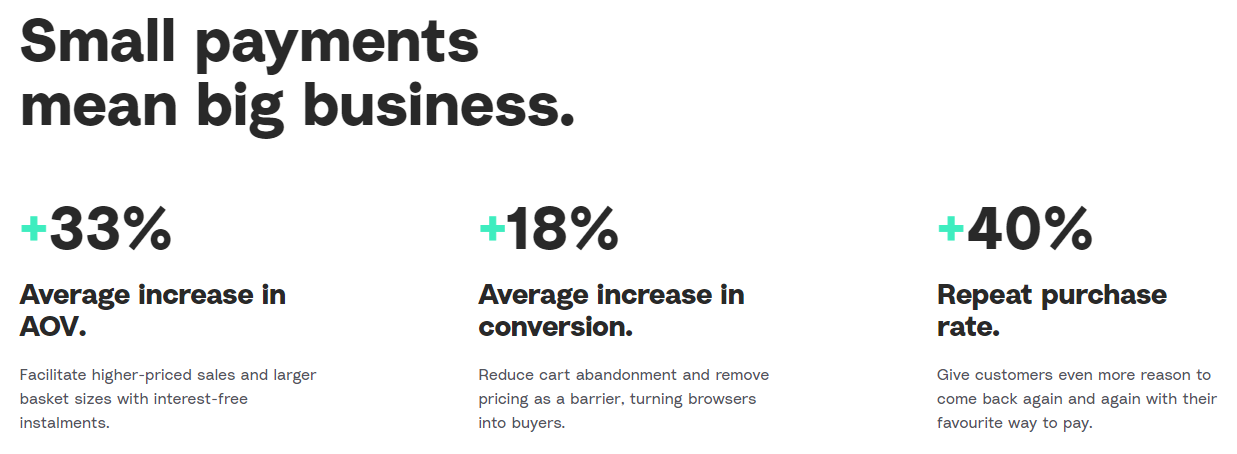

Businesses in UAE can attract broader customers, which helps increase sales, boost customer trust and loyalty, and helps e-commerce platforms increase online conversion rates. It’s a win-win for sellers and buyers, providing the customers with payment solutions and empowering businesses.

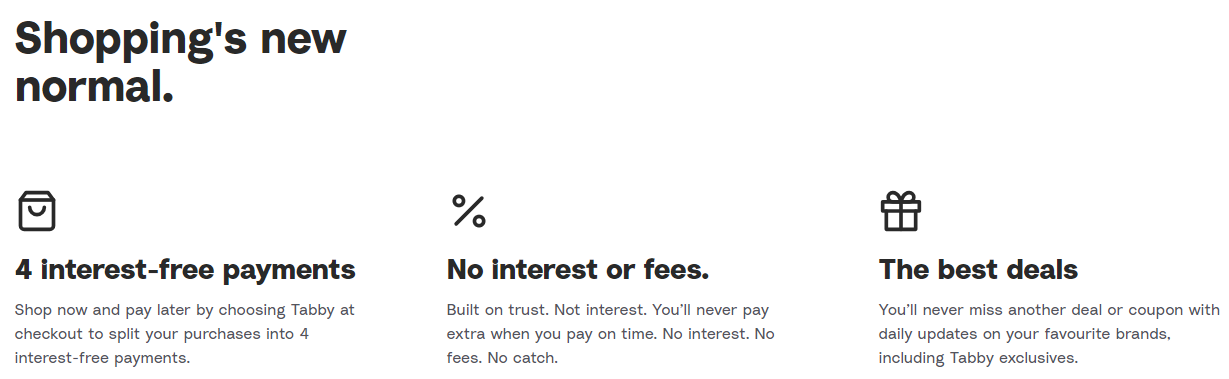

What are the benefits of using Tabby

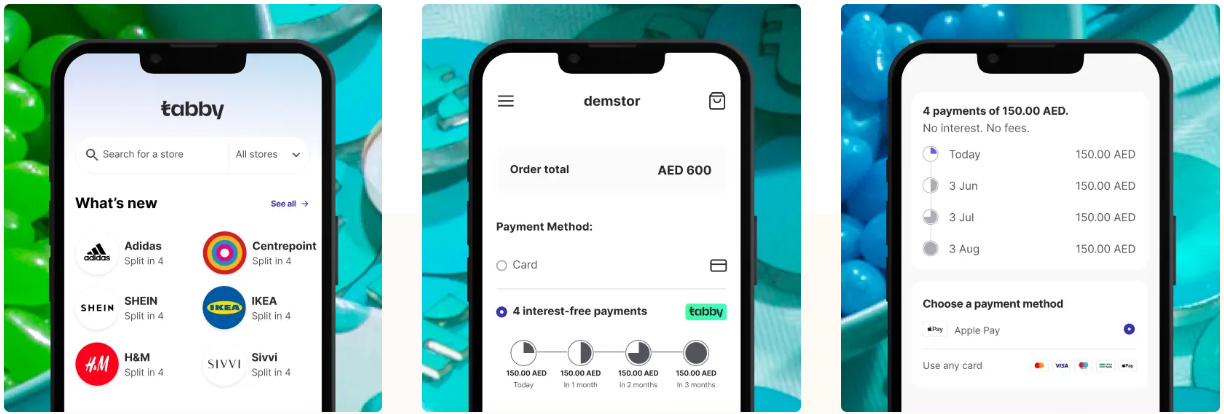

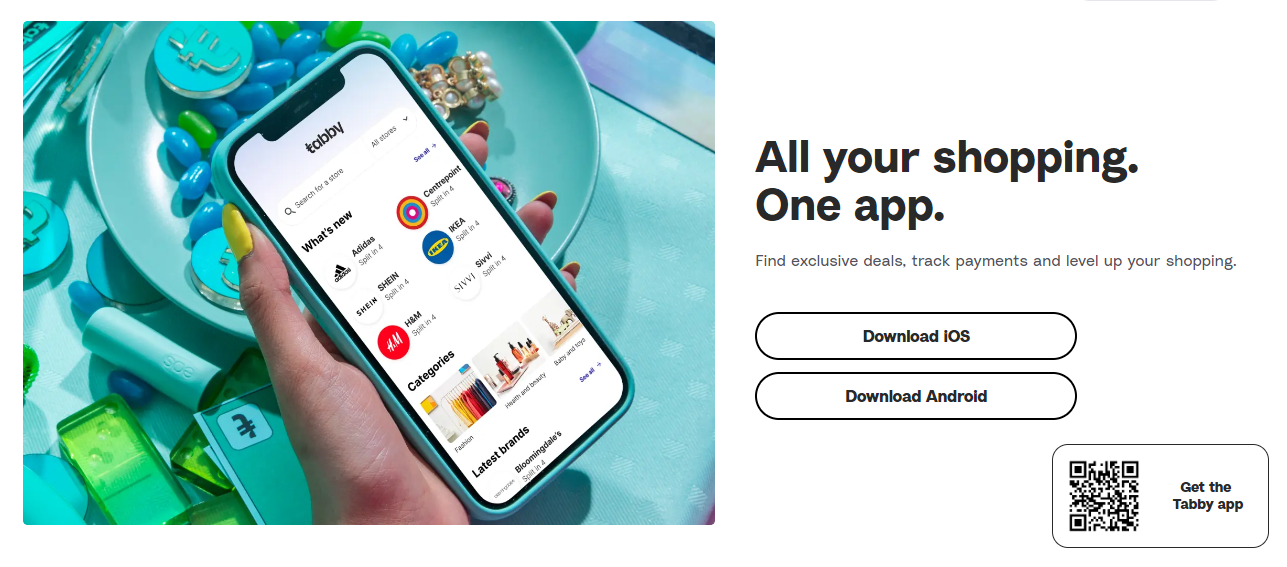

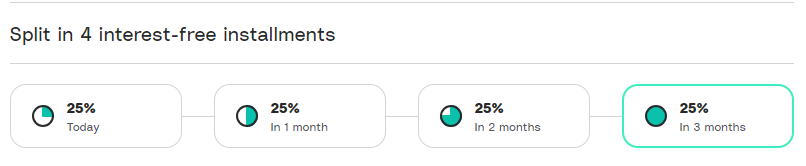

Tabby allows customers to pay for their purchases in 4 installments. The installments are interest-free, and the payment method is Shariah-compliant. There is no fee involved either. All the customer has to do is use the Tabby app at checkout.

Tabby’s payment system lets users track their payments and finances. One can use the Tabby app to keep track of their orders. It also shows your balance and the upcoming bills you must pay, making it easy to track your finances.

In which countries does Tabby operate

Tabby operates in different countries in the Middle East, like the United Arab Emirates, Egypt, Saudi Arabia, Bahrain, and Kuwait.

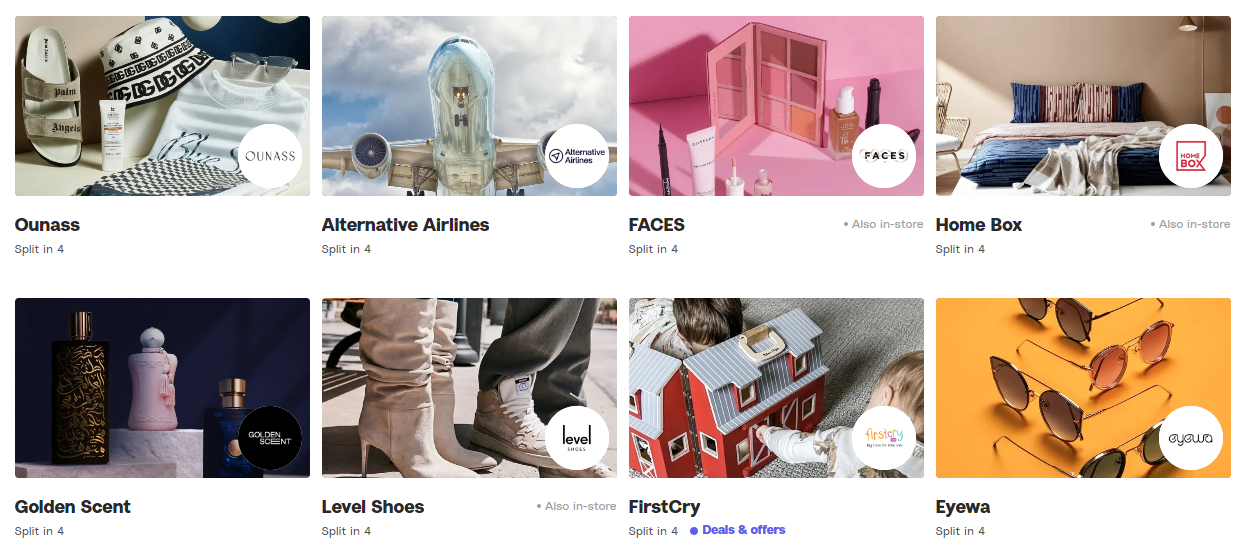

In which shops and brands does Tabby work

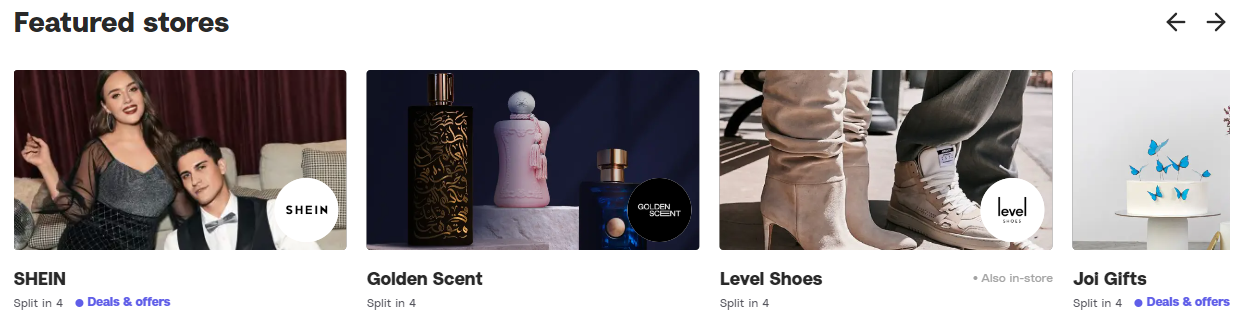

Tabby has a wide range of shops and industries to shop from. The options vary from Fashion, Health and beauty, electronics and home appliances to fitness and outdoors, travel, Automotive, insurance, Training and courses, clinics, Super Mart and entertainment, and much more.

How to pay using Tabby online

Tabby can be used to pay either online on the website or app or can be used in stores as well. Following is the guide about how to use Tabby online to pay in installments:

Step 1: Download the app

Tabby has an app for iOS as well as Android. Users can download it on their phone, sign up, and set up an account.

Step 2: Find your favorite brand

Once the app has been set up, users can find the brands they want to shop from. Thousands of brands are available, including SHEIN, IKEA, etc. The user can shop from all these brands by simply browsing the app.

Step 3: Tabby at Checkout

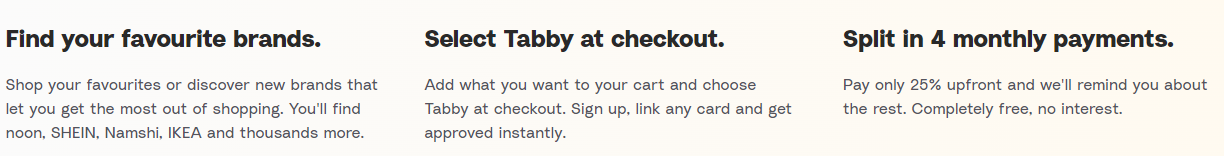

Once the user selects the item they want to shop and adds them to the cart, they must go to the checkout. On the checkout, they have to choose Tabby.

Step 4: Link card

There is the option to link your card. Users can link any card they want to pay from, like Mastercard, Visa, Apple Pay, etc.

Step 5: split the payment

Tabby splits the payment into four installments. The user only has to pay 25% upfront. The rest of the payment can be paid over the course of 4 months. The app reminds you to pay for the rest.

How to use Tabby to pay in store

When buying from a store, the customer can avail of Tabby’s services to pay in installments instead of paying the full amount upfront. Following is the guide about how to use Tabby to pay in-store:

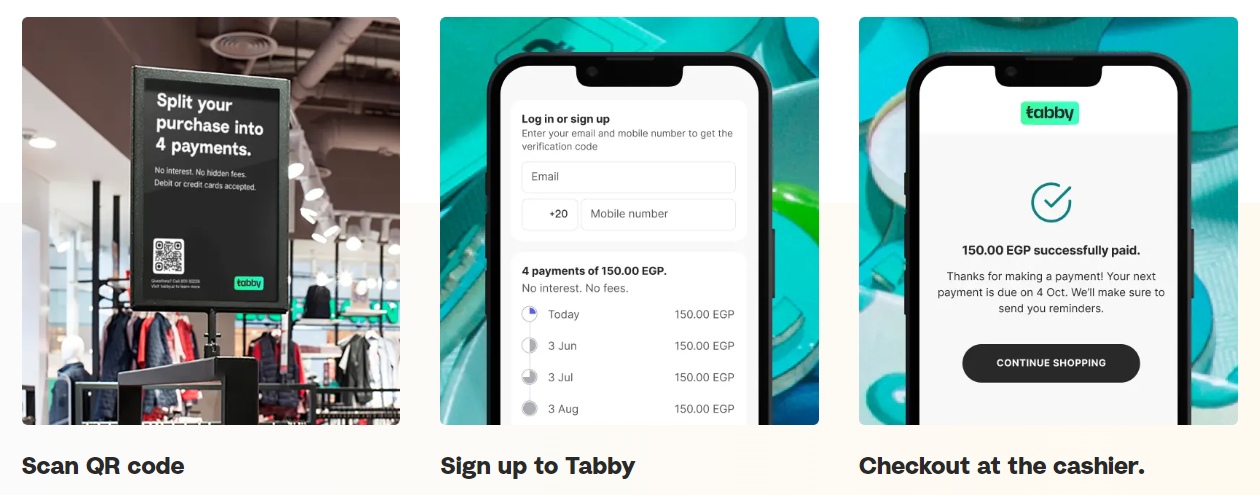

Step 1: Scan the QR code

Majority of the stores in the countries Tabby operates in have a QR code for the customers to scan. All the customer has to do is find and scan the QR code. This will take the customer to the Tabby app.

Step 2: Link the card

The next step is to link the card the customer wants to pay from. It could be a credit card or a debit card. The customer will get instant approval, so there won’t be any delay in the payment process.

Step 3: Check out

The customer can then check out at the cashier and pay only the first 25%. The rest can be paid in installments over the course of 3 months.

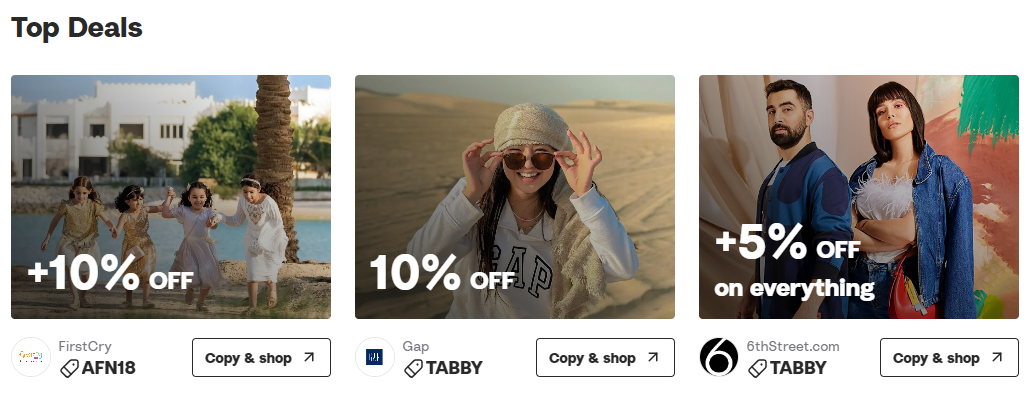

Are there deals on brands on the app

The Tabby app has new deals on various brands at all times. Different deals and sales are available on different brands that the user can avail of by downloading the app.

Is Tabby Shariah Compliant

Tabby provides its services and allows the user a rewarding experience by following the terms and conditions of Islamic Shariah. Along with that, tabby also promotes ethical spending ad responsible response habits.

Tabby is uninterested in the payments and has no fees or additional charges. The retailers pay Tabby for its services instead of earning interest on the products sold.

What is Tabby’s card

Tabby has incorporated finance technology in its payment system to enhance the customer experience by making it easy to pay in-store using the Tabby card, which works like a regular card. It is an online card that can be set up and operated in different stores. Setting up is a one-time process that doesn’t require prepaid top-ups. There are no charges for setting up the Tabby card.

How does Tabby Card work

It is an online payment method that allows users to add Tabby card to their digital wallet and use it in stores to shape and pay in four installments. Tabby card is a digital Visa card that allows digital transactions.

How to get a Tabby card

There is an eligibility criterion to apply for the Tabby card. The user must be 18 years old at least. The user has to be a UAE resident. The user should have a good previous credit history.

Steps to apply for the Tabby card

Step 1: The user has to open the tabby app.

Step 2: the user can locate the Get your card option on the app’s home screen.

Step 3: It will require the user to provide their ID card details. The user will have to scan the front and back of their Emirati ID. Scanning the chip is holding the Emirati ID card near the phone for 10 seconds.

Step 4: The next step is to take a picture or a selfie to verify.

Step 5: Once the user is all set up, they can add the card to their wallet. Currently, the card is available on an invite-only basis. However, the user can always join the waitlist until it gets available.

Is there a limit on how much one can spend using a Tabby card

The amount a person can spend, called the available limit, is set up at an individual level. This limit is assessed regularly, allowing users to spend as responsibly as possible. The available limit is visible on the app home in the Tabby app and the person’s profile screen.

How to find the stores where the Tabby card operates

There are many stores where the Tabby card operates, which can be found using the Tabby app.

What happens if a customer fails to pay installments on time

Tabby provides the customer will ample reminders so that the person doesn’t miss any payment. However, if the person still fails to pay the installment on time on the scheduled day, the tabby doesn’t allow the person to use their services. The user is banned from using the app to buy anything until the pending payments are cleared.

How does Tabby impact the payment system

Tabby is a fintech startup based in UAE that allows users to make payments in four installments, providing users with a flexible digital payment plan that enhances business and sales.

To see how Tabby’s disruptive payment method affects the payment system, we will have to take a closer look at how it’s different from conventional single payment method as well:

- Tabby’s buy now pay later payment method makes it easy for UAE users to enjoy their favorite products without worrying about paying in one go.

- UAE Customers can make bigger purchases by spreading the total payment over months.

- This method creates a win-win situation for both the buyer and the seller. Because of the flexible payment method, more customers are attracted to businesses.

- This enhances the customer base, adds customer loyalty, and in hindsight, increases the business’s overall sales, making Tabby an attractive option.

- Tabby’s payment method will also help reduce card abandonment rates.

- When the buyer finds an option to pay the amount in installments, it increases the overall customer trust and boosts conversion for the UAE e-commerce businesses.

Why should the UAE customers prefer tabby

| Credit cards/Cash payments | Tabby’s Buy now pay later method |

| Difficult to make full payments | Easier to make payments |

| Less flexible | More flexible payment plans |

| Interest rates applicable | No interest rates |

| Long approval process | Easy approval process |

| The customer has to pay the full amount, so avoid buying | Easy to buy products that wouldn’t be possible otherwise |

| Credit cards maxed out. | No need to worry about card maxing out |

| More abandonment rates | Fewer abandonment rates |

| Payments impact credit card history. | No hard credit payment checks, less negative impact on credit history |

Read More Startup Stores:

UAE AI startup Bedu wants early-mover advantage for $7m pre-seed funding

Discover the Top 25 Apps Every Middle Eastern Student Needs to Succeed in School 2023

Conclusion

Tabby, UAE’s Fintech startup’s Buy Now Pay Later payment system, is reshaping and revolutionizing how people spend and shop. The flexible payment plans allow the users to pay in four installments, enhancing customer satisfaction and significantly increasing seller sales. With no interest rates and Shariah compliance, Tabby is one of the best ways to shop online and in-store without adding a financial strain to your pocket.